According to an op-ed by Peter Svab and published by “The Epoch Times,” “The U.S. federal government has borrowed so much money that, over the past year, it has had to spend one-fifth of all the money it collected just on debt interest–which came to almost $880 billion.” (Sidebar: Think about the other programs that…

Category: Inflation and the National Debt

Thinking about the federal debt reminds me of a line from the movie “Regarding Henry” starring Harrison Ford. Actor Ford’s character is an attorney whose life is upended after a bullet hits him in the head. The once-powerful lawyer has to re-learn everything. In a pivotal scene, Harrison’s character says to his former secretary as…

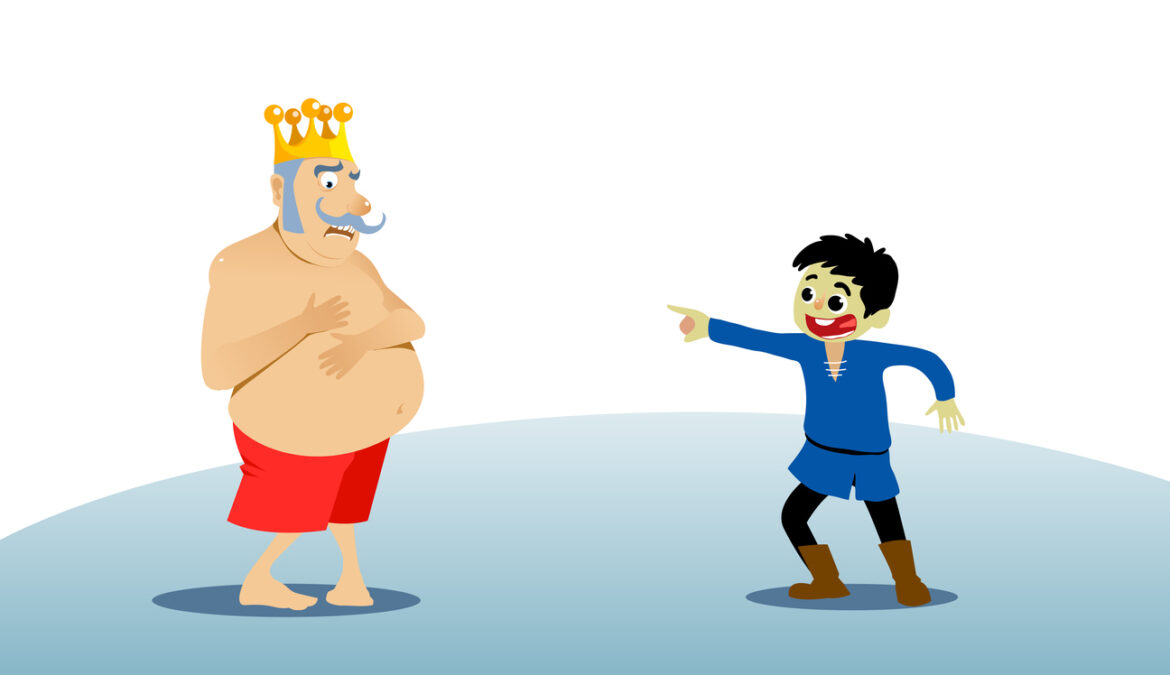

The Correlation between the National Debt and the fairytale “The Emperor’s New Clothes”

According to Bing AI, “The moral of the story “The Emperor’s New Clothes” is that people should not be afraid to speak the truth, even if it goes against popular opinion or authority. In the story, everyone pretends to see and admire the emperor’s new clothes because they fear being seen as foolish or going…

Solving the Debt Crisis is a Bipartisan Issue

If our nation’s leaders were truly concerned about “We the People,” there would be more reaching “across the aisle.” All we see are partisan attacks and in-fighting. It’s time to find some common ground. There have been at least two Master Classes featuring opposing political icons who successfully found some common ground – Karl Rove…

Lying Prices Keep America Hooked on Spending

It’s alarming how the following article written by Steve H. Hanke and Stephen J.K. Walters that appeared in the January 8, 2019, print edition of The Wall Street Journal is as relevant today as it was at the time of publication: “When politicians hide the cost of government, ‘free college’ and ‘Medicare for all’ sound like…

Does Congress need an Intervention?

According to the Webster online dictionary, “intervention” refers to a situation where a group of family or friends confront an individual with an addiction or behavioral problem to encourage them to address the issue. In this case, the issue at hand is Congress’s out-of-control deficit spending. With few exceptions, our elected officials aren’t being good…

Time to wake up and smell the debt

Ian Haworth in his Op-Ed published by “The Washington Examiner” on July 3, 2023 says that “one area should be sparking terror among the populace: debt.” Notable comments in his Op-Ed follow: “And why, as we stare down the barrel of passing the highest level of debt recorded in American history at 106% of GDP…

Other Countries are putting the “brakes” on spending while the U.S. kicks the can down the road.

Germany implemented a fiscal sustainability plan similar to the Swiss Debt Brake in 2009 to reign in excess spending. The German Finance Minister reported on Marcy 7, 2023 that the country “is sticking with it.” Former Magna International CEO Frank Stronach sounded the alarm on Canada’s rising national debt calling it a “ticking timebomb…

Swiss Debt Brake – What is it? Will it work for the U.S.?

There was a recent political cartoon depicting an elephant and a donkey kicking the proverbial can down the road. It seems that every debt ceiling debate results in more national debt, not less. Isn’t it time to take a stand and do something about the debt to save the country and the future of the…

The Misery Index – Is the U.S. a Happy Nation?

The original Misery Index was created by economist Arthur Okun, a member of President Lyndon Johnson’s Council of Economic Advisors. The Index was a way to help President Johnson understand how the country was doing by tracking the impact of unemployment and inflation on the population. It was later modified by Robert Barro of Harvard…