Thinking about the federal debt reminds me of a line from the movie “Regarding Henry” starring Harrison Ford. Actor Ford’s character is an attorney whose life is upended after a bullet hits him in the head. The once-powerful lawyer has to re-learn everything. In a pivotal scene, Harrison’s character says to his former secretary as he quits the law firm, “I’ve had enough, so I am saying ‘when.’

The federal debt is a problem. It’s time for “We the People” to say “when,” indicating that we have had enough of our congressional leaders “kicking the can” down the road and all the false promises to fix the debt.

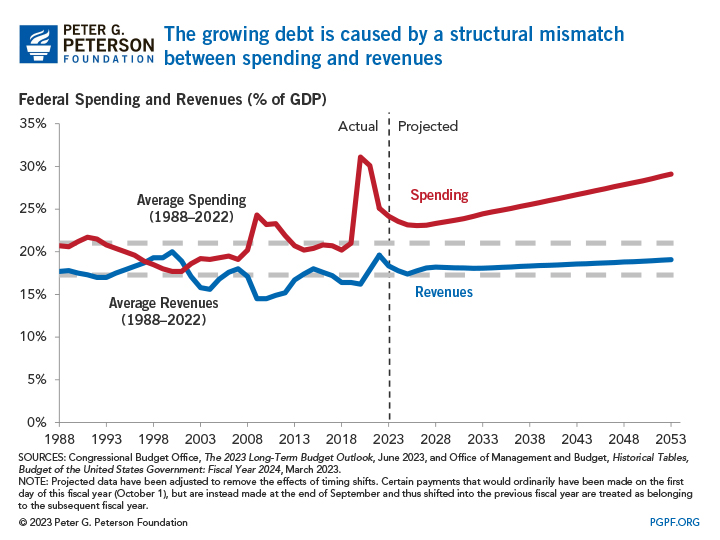

The Peter G. Peterson Foundation provides some drivers responsible for the increase in the national debt:

What is causing the growth of our national debt? The pandemic accelerated an unsustainable fiscal trajectory, but debt was already growing because of a fundamental imbalance between spending and revenues that will continue to grow in future years. CBO anticipates that federal spending will rise from 24.2 percent of GDP in 2023 to 29.1 percent in 2053. Revenues are projected to increase slightly during that period, from 18.4 percent of GDP in 2023 to 19.1 percent in 2053 — which would put the federal government further behind the spending commitments that have been made.

Take a look at the decrease in revenues. As the manager of your home finances, what do you do when your take-home pay is impacted by the rise in interest rates and credit card balances begin to mount? You begin to explore ways to reduce spending costs to align with revenues. You may cut out dining out so many times a week. You may scale down a family vacation to keep within your family budget.

Interest payments on the debt are approximately $395.5 billion. That’s a lot of money that isn’t available for other purposes. Now imagine what programs could be funded with our tax dollars currently being allocated to interest: Head Start Programs, Veterans Benefits, stabilized Medicare and Social Security funding, etc.

In 2012, Dan Mitchel wrote an op-ed titled” How the “Swiss Debt Brake” tamed government.

“Americans looking for a way to tame government profligacy should look to Switzerland. In 2001, 85% of its voters approved an initiative that effectively requires its central government spending to grow no faster than trendline revenue.

The reform, called a “debt brake” in Switzerland, has been very successful. Before the law went into effect in 2003, government spending was expanding by an average of 4.3% per year. Since then, it’s increased by only 2.6% annually.

The Swiss debt brake does not require a balanced budget in the traditional sense. Tax receipts, as we know from the American experience, tend to increase rapidly when the economy is doing well and fall off when the economy stumbles. To smooth out the ups and downs, Switzerland’s debt brake limits spending growth to average revenue increases over a multiyear period (as calculated by the Swiss Federal Department of Finance).”

Fast forward to 2023. Switzerland is still reaping the benefits of the Swiss Debt Brake. Case in point, “Hanke’s Misery Index.” Professor Hanke says, “In the economic sphere, misery tends to flow from high inflation, steep borrowing costs, and unemployment. The surefire way to mitigate that misery is through economic growth. Comparing countries’ metrics can tell us a lot about where in the world people are sad or happy.” Switzerland has the happiest people on the planet. See the Misery Index.

Are you ready to say “When?” Contact your member of the House of Representatives and tell them to support HCR-24 because “their state legislatures have the right to propose and the people to ratify an Amendment under Article V of the US Constitution that promotes fiscal sustainability “to secure the blessings of liberty,” peace, and prosperity, for our country, families and future generations of Americans.”